DEBT SERVICE RATIO

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

Recently, I face a problem. My Client bought a new launch property which is new project in penang. So, she paid the booking to reserve the unit that she love. She applied loan and proceeded to sign SPA (Sales and Purchase Agreement). Waiting to get her new house happily.

Few months after she signed the S&P, bank asking her to pay the interest monthly. She is frustrated due to the agent told her that only need to pay the monthly installment after she get the key of her dream house.

I only realised, many people will forget about the progressive interest.

So,

Progressive interest refers to an interest structure where the interest rate or payment amount increases over time, often associated with certain types of loans or financing arrangements. This method is commonly seen in property financing, where the borrower’s repayment obligations grow as the loan term progresses.

In real estate, progressive interest might apply to development projects, where initial payments are lower while the project is being constructed and increase once the property is completed or occupied. This approach allows borrowers to manage cash flow during the early stages but requires careful planning to accommodate the rising costs in later stages.

Developers typically collect progressive interest at specific milestones during the construction of a property. The payment schedule is usually outlined in the sale and purchase agreement and may include the following phases:

Booking Fee: A small deposit is paid upon signing the agreement.

Construction Milestones: Payments are made at various stages of construction, such as:

Occupancy or Handover: The final payment is often due upon handover of the property, when the buyer officially takes possession.

This structure allows the developer to fund the construction as it progresses while giving the buyer a clearer understanding of when payments are due based on the project’s development stages.

Note !!!

* Subject to developers and project. Can ask your property consultant for the schedule.

You buying a new project. The project price is RM 1,000,000. and you are taking loan from xxx bank. The loan interest rate is 4%. The property is in the stage of completion of the foundation (normally we will call it as Stage 2A). So, they will collect the fund of construction, it might be a 10%.

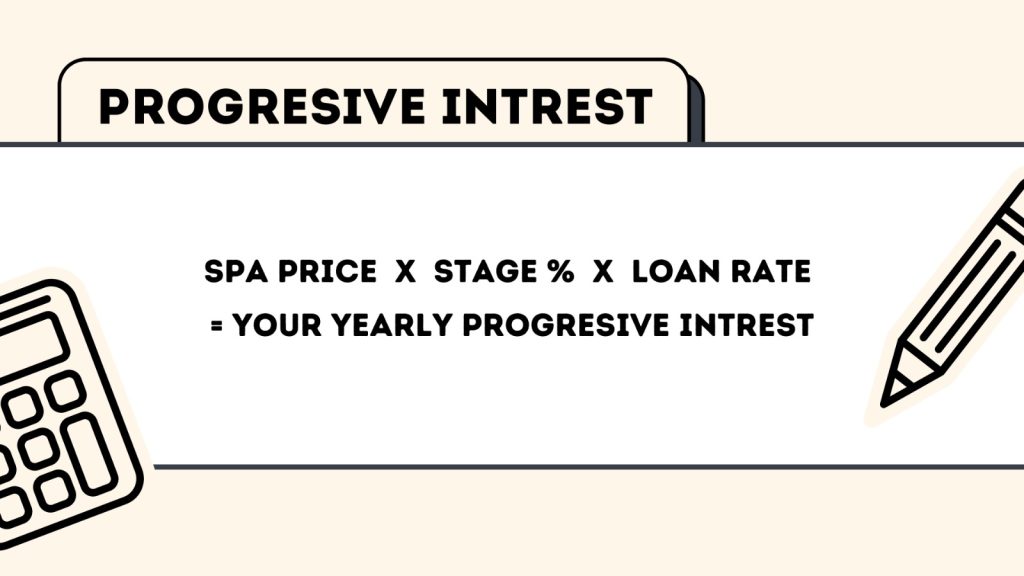

With the formula above : SPA price x Stage % x Loan rate = Your Yearly progressive interest

RM 1,000,000 x 10% x 4% = RM 4,000

RM 4,000 / 12 = RM 333.33 ( Monthly interest)

RM4,000 / 365 = RM 10.96 ( Daily interest)

The total amount of construction interest cannot be calculated because construction interest is cumulative.

*Construction progress is slow: more construction interest is paid than grain

*Construction progress is fast: less construction interest is paid.

Progressive interest refers to the interest charged on a home loan as the property is being built. It is calculated based on the portion of the loan disbursed to the developer at various stages of construction. The developer collects payments at key milestones, such as completion of the foundation, superstructure, roofing, interior, and final handover. Buyers pay interest only on the amount disbursed, which increases as construction progresses.

So, the stage, the date paying, subject to the developer. Please refer to the property consultant.

Happy buying.

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

Buying your first property can be exciting but challenging. Remember to factor in hidden fees like legal costs, agent commissions, and stamp duty in Malaysia.

BEHCHU is proudly powered by WordPress

WhatsApp us