DEBT SERVICE RATIO

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

Buying your first property is an exciting yet nerve-racking journey! You’ve done your homework, chosen the perfect neighborhood with great amenities (and pleasant neighbors), and crafted a solid budget that covers repayments, savings, and miscellaneous expenses. Plus, you’ve found a bank offering a 90% financing margin with a competitive interest rate.

But just when you think everything is in place, you may encounter unexpected challenges. Before you finalize the deal, it’s essential to be aware of additional “hidden fees” that can add up quickly. Beyond the down payment, you’ll need to budget for legal fees related to the Sale and Purchase Agreement (SPA) and loan agreement, real estate agent commissions, and stamp duty fees in Malaysia. Being prepared for these costs can help ensure a smoother buying experience.

ASale & Purchase Agreement (SPA) is a legally binding contract between a buyer and a seller that outlines the transaction’s key details, including terms and conditions, property price, and essential information for both parties. Since the SPA is a mutual agreement, it cannot be renegotiated or amended once signed, and canceling it incurs a penalty of 10% of the purchase price. Therefore, it’s crucial to thoroughly understand the agreement before signing. The SPA also includes important specifics such as payment methods, defect liability periods, property plans, and provisions for vacant possession, along with various clauses that protect the interests of both parties.

Stamp duty, also referred to as a transactional tax, is a fee applied to the stamping of various transactional documents, including loan agreements, tenancy agreements, and property transfer documents like the Sale & Purchase Agreement (SPA). It is a legal requirement that must be paid within 30 days of signing the SPA. Failing to do so can result in penalties ranging from 5% to 20% of the outstanding duty. Ensuring timely payment of stamp duty is essential to avoid additional costs and comply with legal obligations.

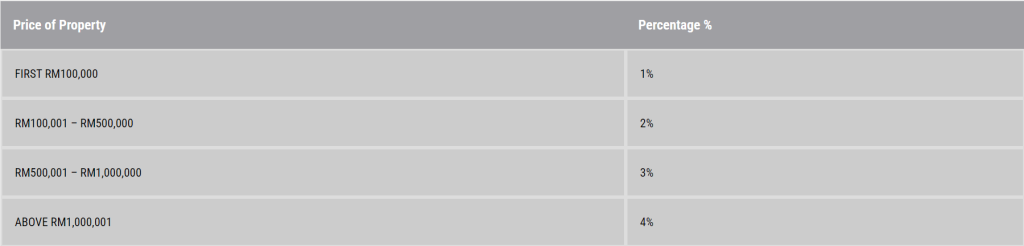

For Instrument of Transfer – The Memorandum of Transfer (MOT) and Deed of Assignment (DOA)

Legal fees are an integral part of the Sale & Purchase Agreement (SPA) and cover the costs associated with engaging legal assistance for the property transaction. Typically, the seller’s solicitor will handle the legal aspects, but buyers have the option to select their own legal representative if they prefer. In some cases, developers may choose to absorb the legal fees to ease the financial burden on buyers, making the purchasing process more accessible. Understanding these fees is important for budgeting and ensuring a smooth transaction.

During the tabling of Budget 2023, the Malaysian government announced exciting stamp duty exemptions for first-time homebuyers! A full stamp duty exemption will apply to both the instrument of transfer and the loan agreement for the purchase of a first home valued at RM500,000 or below, effective until 2025. This means that if your property price falls within this range, you can save up to RM11,250 on stamp duty!

Below is a detailed breakdown of the calculations:

[(First RM100,000 x 1%) + (Next RM400,000 x 2%)] + 0.5% of loan amount, assuming 90% of property price (RM450,000)

Sale & Purchase Agreement (SPA): The SPA is a legally binding contract between the buyer and seller that outlines the transaction details, including price, terms, and conditions. Once signed, it cannot be renegotiated, and canceling it incurs a 10% penalty of the purchase price. Key elements of the SPA include payment methods, defect liability periods, and clauses related to vacant possession.

Stamp Duty: This transactional tax applies to documents such as the SPA and loan agreements. It must be paid within 30 days of signing to avoid penalties ranging from 5% to 20% of the outstanding duty. In Budget 2023, the Malaysian government announced full stamp duty exemptions for first-time homebuyers on properties valued at RM500,000 or below, effective until 2025, allowing for potential savings of up to RM11,250.

Legal Fees: These fees cover the cost of legal assistance for the property transaction and are part of the SPA. While the seller typically assigns a solicitor, buyers can choose their own legal representative. In some instances, developers may absorb these fees to alleviate financial burdens on buyers.

Understanding these components is essential for navigating the property purchase process in 2024.

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

A client expected to pay after getting her new property keys but was surprised by interest payments, highlighting how many overlook progressive interest during construction.

Buying your first property can be exciting but challenging. Remember to factor in hidden fees like legal costs, agent commissions, and stamp duty in Malaysia.

BEHCHU is proudly powered by WordPress

WhatsApp us